On 8 October 2014, I announced my new career as a full-time writer. The actual decision coalesced in the preceding month, but as the public announcement was the Point of No Return, let’s go with 8 October.

This makes 8 October 2019 my five-year anniversary. For one thousand eight hundred twenty seven days, my family has relied on my writing to pay the mortgage. Some of those years, I bought health insurance as well. I do not consult. I do not provide publishing services or rely on affiliate fees. I barely advertise, and that only in the last few months.

I make words. I sell them. That’s it.

I’ve recently come across a bunch of posts about people hitting their one-month or three-month mark as full time writers, like this one from Sacha Black. These posts bring back all the heady delirium of those early days, when I’d finally achieved The Dream.

But the years learn things that the days and months will never know. And here’s some things that time has either taught me, brutally reminded me of, or tattooed on my soul. I’m sure that Lawrence Block, Joe Lansdale, and Lilith Saintcrow would look at my list and say “Oh, he’s adorable,” but I have a ways to go to achieve their longevity.

1) Learn Business and Money

Once your craft becomes your career, you need to manage your craft as assiduously as you would a sandwich shop. This doesn’t take away from the joy of writing. Rather, it can be a different sort of fun. Business and taxes are the world’s most complicated table-top role playing game, under a lackadaisical Dungeon Master who occasionally gets annoyed and goes for Total Party Kill. You best have all your character sheets up to date. Some of it’s tedious–I could do without scanning and saving the receipts for everything I buy. But they’re tax deductions, or potential tax deductions. Perhaps I can’t deduct everything right now, but if my income explodes in 2023 and I need to refile my last few years of taxes, I’ll be thrilled to have them.

If you’re in the US, start by reading Tax Savvy for Small Business.

No, start by reading The Copyright Handbook. I reread this book every year, and I buy every new edition. It’s that important. Remember, authors don’t sell books: we create and license intellectual property. This realization, way back in 1999, was key to me becoming a full time writer.

Wait–you absolutely must read Rusch’s How To Negotiate Anything. It turns the typical authorial introversion into a negotiating advantage. If you can’t negotiate, you don’t have a business.

Real businesses have multiple income streams, and add additional streams any time they can. If you rely on a single income stream, your business is inherently short-lived. Maybe exclusivity with one business has been good to you, but it puts you at the mercy of that company. I won’t sign on exclusively with Amazon. I won’t put all my nonfiction through No Starch Press, exactly as they would not agree to me becoming their only author. A single source of income is short term thinking. My largest single customer (Amazon) is less than a third of my income. Losing them would suck but I’d survive.

Before you make a thousand dollars a year writing, establish your writing as a business. Pick a company name and register it as a DBA in your county. Use that to get a bank account for your business. Deposit all writing income in that account, and use that account to pay for writing-related expenditures. Withdraw money for you and your family as owners’ disbursements. This might seem like overkill now, but you have no idea what’s coming…

2) Plan For Success

Most small businesses fail in their first year. The survivors often fall to their own success.

Treat your writing business like a business from day 1. If the tax man comes knocking on your door you need to be able to demonstrate that you’re treating this part of your career seriously. This means setting up a bank account for the business, and treating that bank account like it belongs to a separate entity. Yes, you can use writing income for vacations but you must account for it.

It’s much easier to convert your DBA to some sort of corporation than to spin one of those entities out of the fabric of your life. Why is this important?

3) You Have No Idea What Will Sell

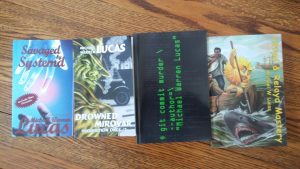

You never know what readers will react to. You have less idea what will bring in new readers. My most successful book is a novelette of satirical Linux erotica. My new crime novel is doing far better than I expected. I could never have predicted this.

Meanwhile, the technology book I spent six years working on? The one I literally wrote seven books to learn how to write? The one people requested, demanded, and beseeched me for?

Sales-wise, it’s dead on arrival.

You never know. It’s uncomfortable. Learn to be comfortable with being uncomfortable. Sow all your seeds, and harvest whatever grows.

4) Try Weird Things, in Craft and Business

I wrote the aforementioned satirical Linux erotica in a single day. The Muse came upon me. He had a whip and a chair and demanded that I perform. I went with it. It succeeded. Other ideas, written similarly, did not. It happens.

Most of us feel just fine with craft experiments, but avoid experimenting in business. What’s the worst that can happen if a business experiment fails? Obviously, the Art Police show up and suspend your license to write.

Or maybe you just lose money.

Financial losses happen in business. Decide how much you can risk, and set up your experiment within those boundaries. I’m experimenting with Amazon ads right now, within clearly defined financial limits, and they’re making me money so far. Book sponsorships work for my nonfiction readers. Patreon works for some of my readers.

And those business experiments can give you room for artistic experiments. The SSH Mastery sponsorships gave me the funding to experiment with hardcovers. The SNMP Mastery sponsors are letting me do something unspeakably squamous with that book.

I wrote a nonfiction book for the deliberate and explicit purpose of telling men’s rights activists that I would continue to use both male and female pronouns in nonfiction. This experiment worked, both in a business sense and for getting those people to stop trying to enlist me to their cause.

“Nobody would buy a cozy mystery set at a Unix conference!” I wrote git commit murder anyway. It’s a slow but steady seller.

Experiment. Sometimes, good stuff happens.

5) Grab Success

You can’t predict success. Except when you can.

The key component of success is being myself. To put myself in my books, as forcefully and explicitly and gleefully as I can.

In other words: I speak the truth.

In my nonfiction, people accuse me of making jokes. I do not. It’s just that the truth in technology is offensive, outrageous, and downright obscene. People must laugh about it, because the appropriate degree of piteous sobbing takes too much time and runs up the cleaning bill.

I do the same in my fiction, but in a completely different way.

And it’s led to financial success.

When that success appears, be ready to grab it. I’m still not making near as much money as I would have if I’d stayed in the technology field, but if I’d stayed in tech I’d have drowned in my own bile by now, so it’s a wash.

I am at the point where I need to reorganize the business, to switch from little old me to a corporation. I’m actively hunting an accountant who understands how creators and licensors of intellectual property can arrange their business to maximize effective income. Turns out those people are mostly on the coast, not here in Detroit. (If you know of one, I’d appreciate a lead.)

When that happens, though: my business is set up and ready to convert to a massive C-Corp.

What will you do if your new book takes off and a million bucks lands in your bank account before New Years’ Eve? Hopefully the answer isn’t “panic.”

6) Keep Writing

Amidst all of this, keep making words.

Writers get opportunities to travel. My books have taken me to Canada, Massachusetts, Oklahoma, California, Oregon, Virginia, Washington, Arizona, Canada, England, France, and Malta. Next year they’ll take me to Japan, India, and back to Canada. In the last year, these trips have taken more and more of my time.

A four-day trip ruins the week before and the week after for writing. Some folks recover more quickly than I do. Good for them. I just got back from a trip to a city in my own time zone. Not only did I lose the time of the trip, I lost four work days before and ten work days after it.

I hereby resolve to stay home and spend more time making words. To stop “Being A Writer,” and to just write.

Over the years, I’ve promised to go to a bunch of cons. The last few years I’ve tried to fulfill all the promises Younger Lucas foolishly made. I have one final set of promises to fulfill, in Asia next March. And then I’m done. I’m not promising any more “sure I’ll come, one year” trips.

Will I travel? Sure. But rarely. If I don’t write, there are no books. And traveling prevents writing.

7) Forgive Yourself

I write fiction at about a thousand words an hour and nonfiction at about half that. If I treat my writing as full-time a job, and split my time between the two, I should produce a million words of fiction and half a million words of nonfiction every year.

That’s not realistic.

First, you must allocate time to run your business. When I use a publisher, I have to manage that relationship. When I self-publish, I must spend time publishing. No matter what, I must balance the credit card statement every month and deal with the accounting.

And experienced employers know that even the most solid employees are useless 5% to 50% of the time. Marriages, births, divorces, illness, car troubles, exploding toilets, and the other Randomly Falling Meatballs of the Flying Spaghetti Monster disrupt us all. It’s called being alive. Being human.

As authors who have finally achieved The Dream, it’s easy to beat ourselves up for our shortcomings. Things happen. In the short term, it’s infuriating and frustrating and can drive us to tears of rage.

But our craft means nothing if we lose our friends and relationships and all those things that make life worthwhile.

Despite thyroid failures and anemia and cancer scares and family members suffering time-consuming medical problems over the last five years, I’ve written dozens of books. The bills are paid.

Forgive yourself.

I shouldn’t forgive myself, mind you, because I know in my heart that I’m a slacker and I should be writing twelve hours a day, seven days a week, and use the time left over for business. But that’s a separate matter. You must forgive yourself.

8) Keep Learning Craft

This is the key to everything. It’s the most important thing you can do.

Learn. Study. Practice.

Practice is how we learn. I treat everything I write as deliberate practice. In my current fiction project, because of the nature of the project, I’m practicing point of view. Yes, I have decent point-of-view chops. They can be better. In my current nonfiction project, I’m practicing clarity. The baroque language of SNMP lends itself to such practice.

Yes, I’m a full time author. People pay me for my words. I rely on those payments to pay the mortgage.

But I either get better or stagnate. And my readers will go “oh, it’s more of the same” and move on to someone else.

I must grow with my readers. It’s the only way I’ll keep the ones I have, and draw in new ones.

Finally:

9) Don’t Ask How You’re Getting Away With This

The universe might catch on and put you back in your place.